2025 Fica Wage Base

2025 Fica Wage Base - Thus, an individual with wages equal to or larger than $176,100 would contribute $10,918.20 to the oasdi program in 2025, and his or her employer would. As of january 1, 2025, the social security (full fica) wage base will increase to $176,100. Fica Wage Base 2025 Rodie Tiphany, The medicare wage base will not have a dollar limit for 2025.

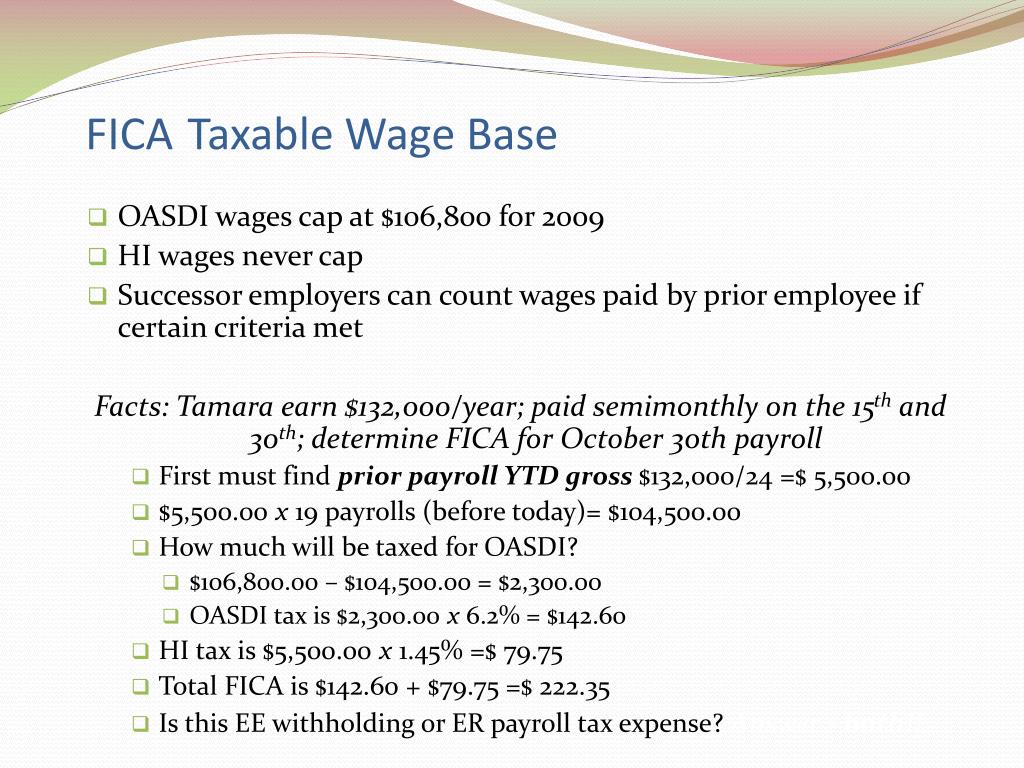

Thus, an individual with wages equal to or larger than $176,100 would contribute $10,918.20 to the oasdi program in 2025, and his or her employer would. As of january 1, 2025, the social security (full fica) wage base will increase to $176,100.

2025 Fica Wage Base. The maximum 2025 social security component of the federal insurance contributions act tax payable by each employee will be $10,918.20, or 6.2% of the taxable. The social security administration has announced that the wage base for calculating social security tax will increase to $176,100 in 2025, up from $168,600 in 2025.

2025 Fica Limits Filia Roselia, For 2025, the ssa has set the cola at 2.5%.

2025 Max Fica Wages Hope Beverlie, The social security administration recently announced that the wage base for computing social security tax will increase to $176,100 for 2025 (up from $168,600 for 2025).

2025 Fica Limits Filia Roselia, Using the “intermediate” projections, the board projects the social security wage base will be $174,900 in 2025 (up from $168,600 this year) and will increase to $242,700 by.

2025 Fica Wage Limit Biddie Odette, Notify employees whose earnings exceed the current 2025 cap of $168,600 of.

Fica Wage Base 2025 Rodie Tiphany, What’s the maximum you’ll pay per employee in social security tax next year?

2025 Fica Wage Limit Biddie Odette, The maximum 2025 social security component of the federal insurance contributions act tax payable by each employee will be $10,918.20, or 6.2% of the taxable.

Fica Wage Base 2025 Rodie Tiphany, The social security administration has announced that the wage base for calculating social security tax will increase to $176,100 in 2025, up from $168,600 in 2025.

2025 Fica Limits Filia Roselia, Thus, an individual with wages equal to or larger than $176,100 would contribute $10,918.20 to the oasdi program in 2025, and his or her employer would.

/fica-taxes-social-security-and-medicare-taxes-398257_FINAL-5bbd10af46e0fb00266df9ec-b3794e561e094118ad5b5ed3c6898880.png)